Cost Segregation =

Accelerated Depreciation

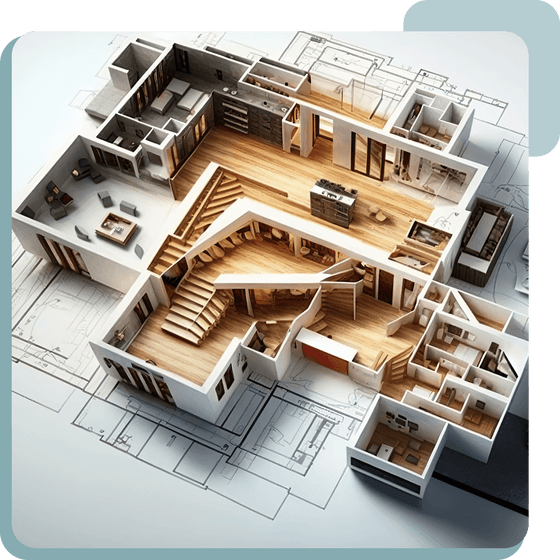

A cost segregation study is a process used for income tax purposes that examines the various components of a property, such as plumbing fixtures, carpeting, and sidewalks, which are typically part of a building acquisition or development. Instead of depreciating these components over the same useful life as the entire building (27.5 or 39 years), the study categorizes them separately. This allows property owners and investors to benefit from an accelerated depreciation timeline for certain building elements, potentially resulting in tax savings.

Start Saving Now

Small firms don't do Cost Segs. Big firms charge too much.

Our cost segregation team uses a lean approach that takes advantage of cost efficiencies of batching site visits when engineers are needed on the ground and, when not needed, we deploy other non-engineer professionals who live near the property to perform site visits guided by a remote engineer.

Start Saving NowThe "low-cost" providers'

due diligence leaves you

exposed.

There are more than a few firms out there who do cost segregation studies without an appropriate level of due diligence and documentation. They won’t corroborate their studies with engineers, industry benchmarks or cost seg data on comparable properties. And, they won’t conduct a visit to the property site, even when it’s necessary. These studies cost next to nothing, except when the IRS blows up said “study” hitting the taxpayer with additional tax, penalties and interest. Suddenly, that study becomes quite costly.

Start Saving NowYour tax pro didn’t suggest doing a

cost seg study because you didn’t ask

Most tax pros have very little experience with cost segregation studies and don’t know reputable cost seg firms to refer clients to, assuming they both knew when it would make sense for a client and were capable of delivering the planning advice to the client.

Too many times, this tax planning opportunity is glossed over or entirely ignored.

Which Type of Property Qualifies?

Cost segregation can be done for buildings purchased or built since 1986, and that includes renovations. It’s especially beneficial for large-scale property developers and investors. You don’t need to be big to benefit, though. Cost segregation applies to many types of properties, including, but not limited to:

The 3-Step Process is Simple,

Intentionally.

We’ll perform an evaluation as to whether the tax savings will substantially outweigh the costs, including impacts on timing of cash flows

If it makes sense, our Cost Seg team will kick off the study and will keep you in the loop at each stage of the process

We’ll claim the accelerated deductions on your behalf in the most tax-advantaged manner possible

Your Cost Segregation Experts

Are You Ready?

There is a lot to unpack when it comes to each individual's unique tax planning strategies. If you would like to see if we can help, reach out today.

Start Saving Now

Find Your Dark Horse CPA

When you work with Dark Horse, you're actually working with your very own Dark Horse CPA, instead of a rotating roster of staff like you get with the traditional CPA firm. Select a specialty below to get matched with the right CPA.

Locations

Because we're entirely cloud-based, we can work with you from anywhere. If you prefer to work with a local CPA, check out our quickly growing list of locations.