Claim Your Employee

Retention Credit

Were you able to retain employees during the COVID-19 pandemic despite your business activities being impacted? If so, you may qualify for a refundable tax credit of up to $26,000 per W2 employee, even if you've already collected the Paycheck Protection Program (PPP) loan. If you qualify, Dark Horse CPAs will make sure you get what you’re entitled to.

See If You Qualify

Rewarding Employers for Retaining Employees

The Employer Retention Tax Credit (ERTC), also called the Employee Retention Credit (ERC), is a refundable tax credit (not a loan or grant) that’s part of the CARES Act. It was designed to encourage employers to keep their employees on the payroll during the pandemic.

Many companies will qualify, and it’s money you don’t have to pay back. Once you apply and qualify, the IRS will send you a check, and you can keep the money. It’s that simple.

See If You QualifyWe are not an ERC mill! There are too many non-CPA firms out there trying to file as many Employee Retention Tax Credit claims as possible, lacking the requisite expertise, context and integrity to file your ERC accurately. Many of these companies started up overnight and will be out-of-business by the time you get audited. If you want to be sure that you truly qualify for the Employee Retention Credit, with supporting documentation, Dark Horse and the companies we partner with will ensure that your ERC claim can be supported under audit.

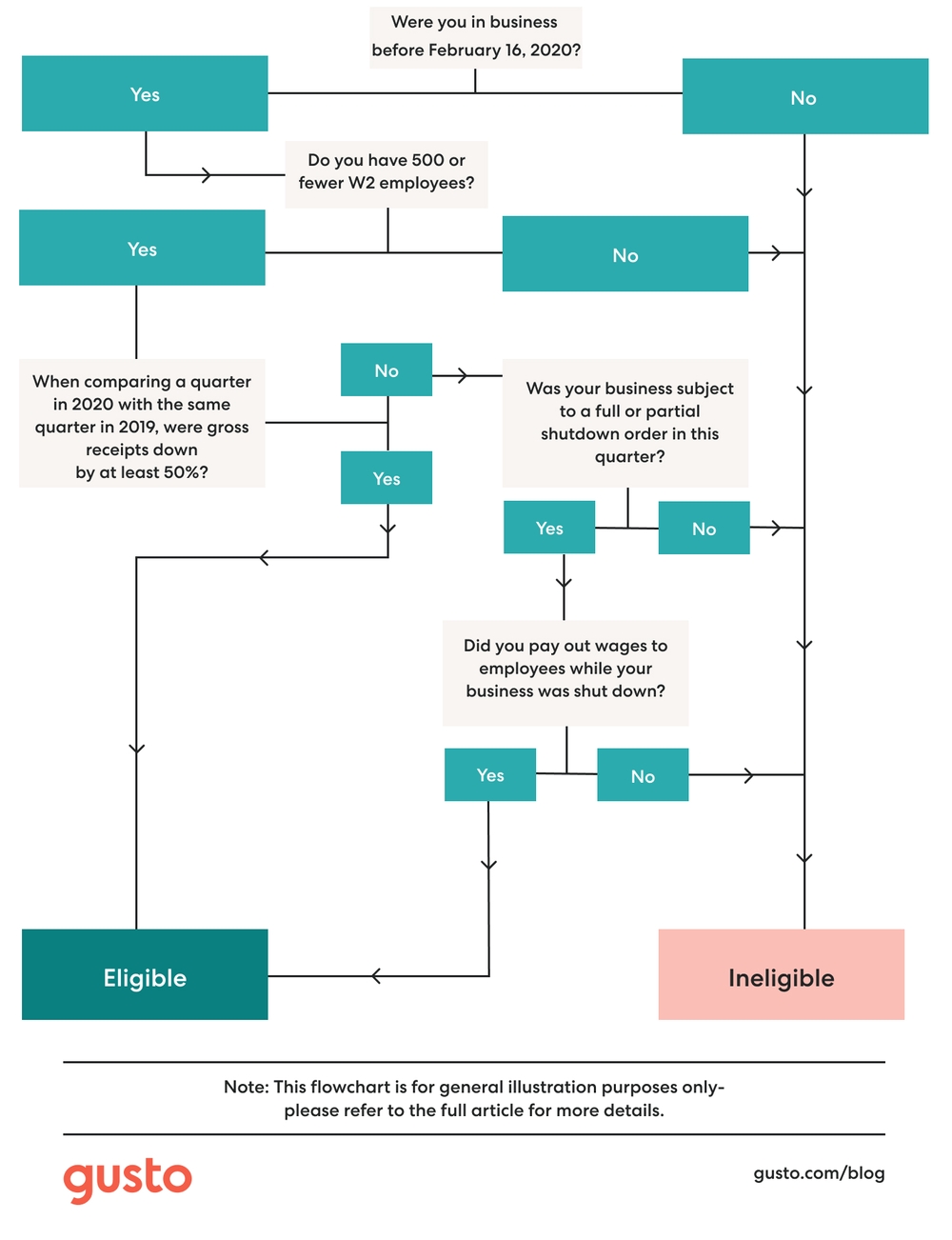

What Are the Eligibility Requirements?

To claim the Employee Retention Credit, you must have been in business in 2020 and meet one of the following criteria

See If You Qualify- Your business operations were either fully or partially suspended by government order.

- You had a significant decline in gross receipts compared to 2019

- Recovery startup businesses launched during the pandemic and with less than $1 million in gross receipts may also qualify for ERC (for the third or fourth quarters of 2021).

- Even if you collected one or both rounds of the Paycheck Protection Program (PPP and PPP2), you may still qualify. You won’t, however, be able to double-count wages used for either round of PPP forgiveness as qualified ERC refunds.

Verify If Your Business is Eligible for ERC for Tax Year . . .

- 2020 |

- 2021-Q1&Q2 |

- 2021-Q3 |

- 2021-Q4

credit gusto: https://gusto.com/resources/articles/taxes/employee-retention-credit

Don't Miss the Deadline

To claim an Employee Retention Credit for 2020, you have to apply by April 15, 2024, and for 2021, the deadline is April 15, 2025.

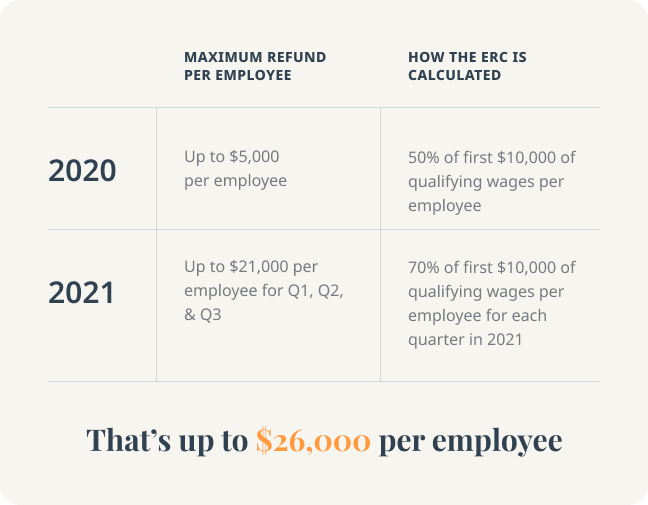

See If You QualifyHow Much Can I Get?

The Employee Retention Credit is one that really stacks up and is worth going after. Dark Horse CPAs can help you calculate your credit and submit a claim.

See If You Qualify

Your ERC Experts

The ERC Can Yield Significant Cash

EXAMPLES OF REAL CREDITS FROM DARK HORSE CLIENTS

Answers to Frequently Asked Questions

Is the ERC taxable?

Yes, but not in the direct way you might think. The ERC refund you receive will increase your taxable income in the applicable tax years as it reduces the tax deduction taken for payroll wages on your originally filed income tax returns. This requires you to amend your prior year's business tax returns to report the increased taxable income, and any ERC refund received must be claimed on the income tax return year that corresponds with the payroll tax return year that was amended. Any ERC refund claimed on 2020 941Xs will be reported on an amended 2020 Income Tax Return, while any ERC refund claimed on 2021 941Xs will be reported on an amended 2021 Income Tax Return.

For example, let's assume salaries and wages were $100,000 in the 2020 tax year and $120,000 in the 2021 tax year. After completing the ERC study, it was determined the client qualified for a $50,000 ERC credit in 2020 and a $20,000 ERC credit in the 2021 tax year. In this case, the 2020 tax return for the business would be amended to reduce the salaries & wage deduction claimed on the originally filed tax return by $50,000, thus increasing taxable income for that year by $50,000. The same cadence would apply to the 2021 tax year.

Which wages fit ERC qualifications?

Any wages paid to qualifying employees after March 12, 2020, and before January 1, 2022, can qualify. Note that 1099 payments made to contractors do not qualify.

Are there any restrictions regarding employees?

The ERC can be claimed for all full-time employees (30+ hours per week) for small employers (defined as 100 or fewer full-time employees for 2020 and 500 or fewer full-time employees for 2021). If your business is larger than that, you can only claim ERC for wages paid to employees for not working.

Wages paid to greater than 50% owners or their relatives are ineligible for the Employee Retention Credit, and it’s important to note that self-employment earnings are also not considered qualified wages.

How long does it take to get the check?

Once you qualify and file your Employee Retention Credit claim, the U.S. Treasury will send a refund check in approximately four to six months.

I really don’t have to pay this back?

No, you don’t. It’s like getting a tax refund—you simply cash the check that the IRS sends you.

What companies do you partner with?

In select circumstances, Dark Horse has partnered with Get My Funds LLC (GMF) to enhance the process of identifying and qualifying clients for the Employee Retention Credit (ERC). At Dark Horse, we handle credit calculations and payroll tax return filings, while GMF assists with qualification and administration aspects. Our collaboration with GMF is based on our mutual commitment to transparency and regulatory compliance. This partnership ensures that credit calculations adhere to the tax code, while providing clients with a streamlined and efficient credit calculation experience.

Net Promoter Score

The average NPS for accounting firms is 38%. At Dark Horse, 94% of our clients would recommend us to a friend.

Net Promoter Score

Companies use this metric to gauge how happy their customers are with their services. It's calculated by taking the percentage of "promoters" minus the % of "detractors."The average NPS score for the accounting industry is 39%, less than the DMV! We believe it's important to share that we have successfully fulfilled our promise to WOW clients and consistently monitor this metric to ensure we continue to deliver on the highest level.

5-Star Reviews

Our Google and Yelp reviews speak for themselves. Our goal is to provide 5-star service to every client, every time.

5-Star Reviews

When someone shares their experience with us online, we find it extremely valuable to know where we've exceeded expectations and where we can improve. Many of our clients decide to engage with us as a result of reading about other Dark Horse clients’ experiences.

Retention Rate

We're all about creating long-lasting, value-added relationships.

Retention Rate

This is the frequency of repeat business from our clients that work with us. This means that 9 out of 10 clients use us for subsequent years. That shows us that people enjoy working with our CPAs, are pleased with the work, and want to continue with Dark Horse over the long term.

Find Your Dark Horse CPA

When you work with Dark Horse, you're actually working with your very own Dark Horse CPA, instead of a rotating roster of staff like you get with the traditional CPA firm. Select a specialty below to get matched with the right CPA.

Locations

Because we're entirely cloud-based, we can work with you from anywhere. If you prefer to work with a local CPA, check out our quickly growing list of locations.